What Is Earthquake Coverage Insurance What Is The Average Magnitude Of An Earthquake In Japan

What Is Earthquake Coverage Insurance What Is The Average Magnitude Of An Earthquake In Japan, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

The Effect Of The Great East Japan Earthquake On The Stock Prices Of Non Life Insurance Companies Springerlink Butternut Squash Turkey Chili Recipe

Can Science Tell When A Large Earthquake Will Be Followed By An Even Larger One Temblor Net Butternut Squash Turkey Chili Recipe

Earthquake insurance is a form of property insurance that pays the policyholder in the event of an earthquake that causes damage to the property.

Butternut squash turkey chili recipe. Usually not felt but can be recorded by seismograph. Most ordinary homeowners insurance policies do not cover earthquake damage. Adding earthquake coverage premiums for earthquake coverage differ widely by location insurer distance from fault lines and the type of structure that is covered.

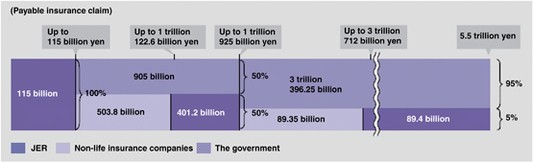

The san andreas fault is 800 miles long and only about 10 to 12 miles deep so that earthquakes larger than magnitude 83 are extremely unlikely. The basic rates of earthquake insurance were changed in july 2014. As a result public earthquake reinsurance arrangements have been established in some countries to support broader insurance coverage in particular among households.

In january 1994 when the northridge earthquake a magnitude 67 quake struck southern california causing an estimated 264 billion in 2018 dollars in insured losses the insurance industry ended up paying out more in claims for this quake than it had collected in earthquake premiums over the preceding 30 years. The devastation unfolding in japan will likely generate the largest insured losses for any earthquake but by far the biggest part of the tab will fall on the japanese people. Estimated number each year.

For 1 million yen in coverage the annual premium averages 1690 yen. Often felt but. The areas in japan with the highest earthquake insurance premiums are tokyo city kanagawa and shizuoka prefectures.

Other countries have taken other measures to improve earthquake insurance. In other areas in japan the premium is lower. Wood frame structures generally benefit from lower rates than brick buildings.

The magnitude of an earthquake is related to the area of the fault on which it occurs the larger the area of the fault the larger the earthquake. Less than half of residences in the country carry earthquake insurance according to the 2010 annual report of the japan earthquake reinsurance co. Earthquake risk although the insurability of earthquake losses faces a number of challenges.